From 2011 through 2021, the earnings yield on the S&P 500 and the yield-to-worst of high yield fixed income had been at equivalent levels. Today, high yield bond yields exceed S&P 500 earnings yields by 3.5%. Higher interest rates are prompting consideration for substitution of equity exposure with high yield or other credit and direct-lending strategies, as portfolios can maintain a similar expected return with less equity risk. However, deciding to change portfolio allocations based only on expected returns is an incomplete analysis, because the equities and fixed income have vastly different returns dispersions.

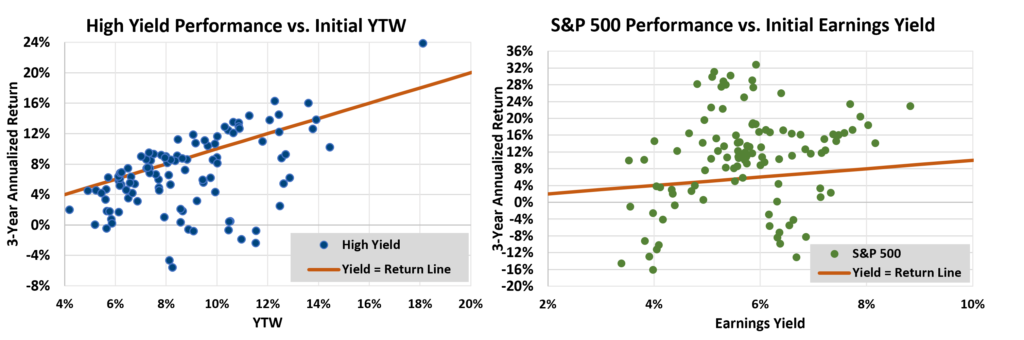

In the charts below, the dots show the quarterly high yield yield-to-maturity and the S&P 500 earnings yield against subsequent 3-year annualized returns. The lines illustrate the points where yields and returns were equal. For high yield, the clustering of the dots near the “yield=return” line shows that starting yield has been a decent predictor of future expected performance. For stocks, the disperse nature of the dots shows that earnings yield has had almost no bearing on future returns. Saying that “adding credit improves returns certainty” is a fair takeaway.

The main drawback from moving from equities to credit is that credit volatility is all downside volatility and can only have a negative impact on return. Stocks have both upside and downside volatility. For high yield, all the meaningful deviation from the “yield=return” line is below the line, which reveals that current yield is a best-case expectation. For stocks, there are deviations both above and below the line, displaying the upside potential for equities. The substitution of equity exposure for credit exposure decision should consider the utility of a more certain expected return against the loss of the portfolio’s growth potential.