Impact Investing

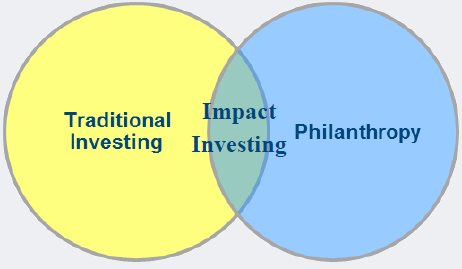

Impact investing has moved into the mainstream, but still represents only a fraction of the socially responsible market. Assets invested in the U.S. SRI space total $12.0 Trillion (Source: US SIF1) versus $502 Billion in global impact assets (Source: GIIN2). Faith-based organizations have long played a role in this early adoption phase mainly through community-based and microfinance initiatives. Impact investing continues to gain traction in the form of investor interest and increasing product availability. According to the World Economic Forum, satisfying the targets of the U.N. Sustainable Development Goals by 2030, will require $5 to $7 Trillion in impact assets.

Proper due diligence of strategies is critical. In spite of the recent growth of the impact investment market, strategies continue to proliferate to meet growing demand. It is therefore important to discern institutional quality mandates from retail-based and start-up offerings. Strategies should be sound from both an investment and social perspective and align with an organization’s values. Investment costs also should receive attention as impact-oriented strategies can at times have unfavorable cost structures that could erode return potential.

A process for ongoing monitoring and evaluation should be agreed upon prior to implementation. The ability to measure the social impact is a core feature of successful impact investing. Third party standards exist to measure a variety of social, environmental, and financial metrics and aid in data-driven evaluation. While these standards lend credibility to the impact movement, effective measurement remains a challenge. Among public companies, lack of disclosure and inconsistent standards for ESG metrics also remain a persistent issue. With continued investor pressure and leadership from larger companies, disclosure is expected to improve with time.

While impact investments nobly aim to achieve both a positive social impact and a profitable return, it is important to keep in mind that just like any other investment, there are risks involved and a less than optimal financial result could be achieved even as worthwhile mission-based goals are being met. Concord urges organizations to seek out advice if they are thinking about impact investing as the endeavor can be complex and time consuming as much as it is rewarding.

2 “Global Impact Invest Investing Network: Sizing the Impact Investment Market”

Concord offers a full range of investment consulting services including the evaluation and implementation of impact investing strategies as part of a comprehensive investment program.

The information presented herein has been obtained with the greatest care from sources believed to be reliable but it is not guaranteed. The Concord Advisory Group, Ltd. expressly disclaims any liability, including incidental or consequential damages, arising from errors or omissions in this publication. The data is presented for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The Concord Advisory Group, Ltd. is a registered investment advisor with the Securities and Exchange Commission, and a copy of Form ADV is available upon request.