With a year-to-date return of 28% for the S&P 500, 2024 has been, thus far, a spectacular year for investors. Beyond returns, investors are starting to enjoy an environment of lower overall portfolio risk. As the year closes, the market’s biggest concerns around central bank policy and global elections have found clarity or resolution. This is particularly impactful in the bond market, where greater transparency on the direction of short-term interest rates has led to lower fixed income volatility.

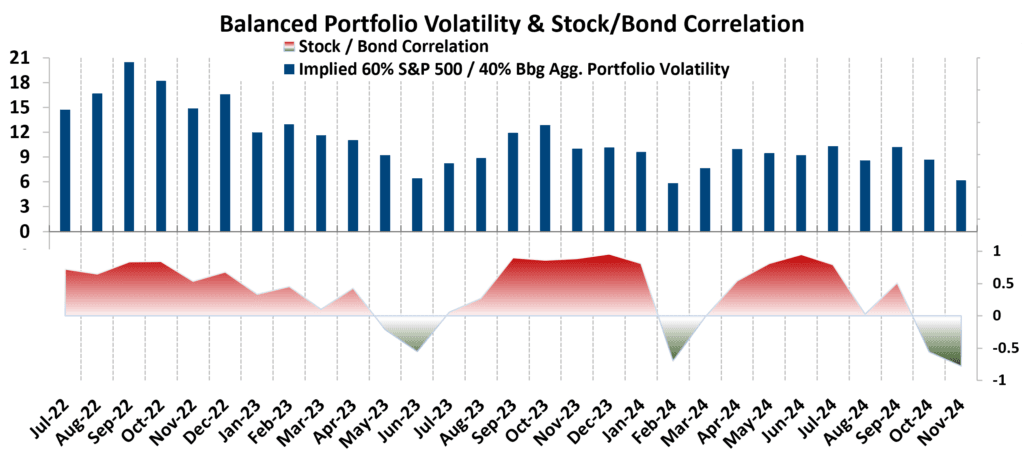

Less obvious, but of considerable importance to investors, is the improving interplay between stocks, and how it affects overall portfolio risk. The chart shows the option market’s implied forecasted 3-month-volatility (annualized) of a U.S. balanced portfolio based on current options prices and trailing stock/bond correlations.

Stock and bond prices tend to move together in periods of elevated inflation and in opposite directions during periods of stable or falling prices. Inflation moderated in 2024, down to a year-over-year rate of 2.6% last month. As a result, the complementary hedging nature of stocks and bonds has returned, which is lowering expected balanced portfolio volatility. If progress on inflation continues, the lower correlation between stocks and bonds should sustain a more constructive risk environment for balanced portfolio construction.