Watching the first few days of Olympic swimming, it is striking to see the narrowing of the time intervals between winning and losing. Higher levels of competition drive gains in efficiency, which in swimming are noticeable and incredible. Video stroke analysis, weight training, nutrition, better coaching, quicker swimsuits that reduce drag, and global talent scouting have led to a larger number of very faster swimmers.

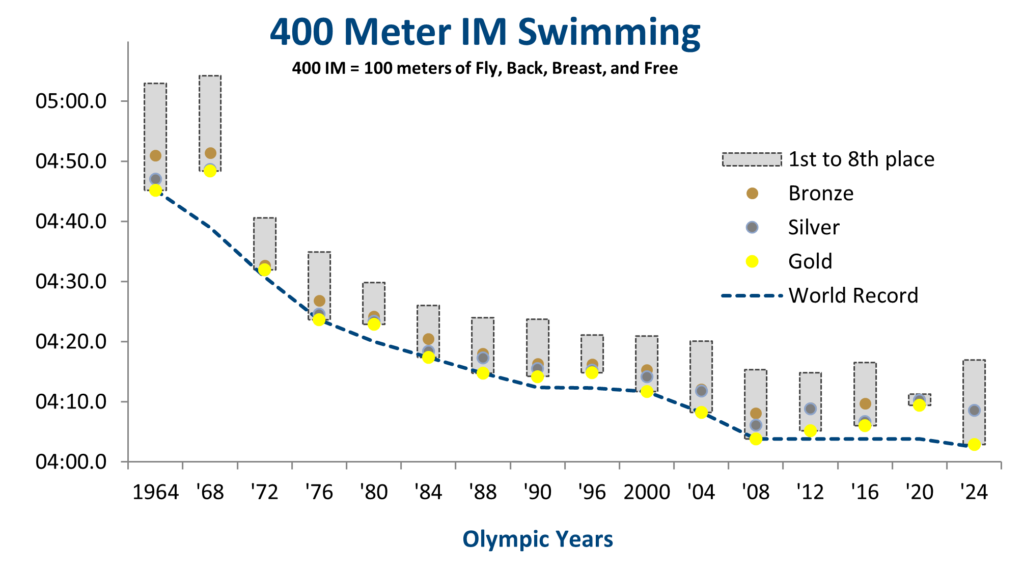

The 400-meter individual medley is a premier and one of the toughest swimming events. It is a good example of competition driving efficiency. Over the last 60-years, the world record has dropped by 43 seconds, a huge improvement in a race that currently takes a little over four minutes to compete. In these games, seven swimmers swam times faster than the world record as it stood in 2000. Finishing after current world record holder Leon Marchand of France, the time differential between the silver medal and seventh place was only three seconds.

Assessing and adjusting to changing competition and efficiency is important in investing. For example, over the last 40 years, competition has greatly lowered the cost of trading stocks. Previously, when evaluating an investment manager in a high transaction cost market, a manager with high stock turnover was a red flag, because trading costs would hurt returns. In the current low transaction cost environment, strategies with higher investment turnover become more acceptable.

One of the keys to investment success is distributing the active management risk budget to areas of the market where competition is less strong. Like swimming, ample competition in the analysis of large-cap U.S. equities has created a very efficient market. Just as representing your country in the Olympic pool is a win, in and of itself, earning an average return of large cap U.S. equities via an index fund in a swimsuit that minimizes drag (i.e., investment management fees) is a very good outcome. In other asset classes, such as small caps, international equity, and fixed income, competition is not as fierce, which gives active managers more exploitable inefficiencies and a better shot of having a medal winning result.