The past two years were challenging for bond investors, but there are reasons to believe that most of the pain from the rout is in the past. The bond market’s valuation, fundamentals, and capacity to handle negative events have all improved.

When thinking about bond valuations, real yields, or expected yields in excess of inflation, provide a better gauge of value than nominal yields. Real 10-year U.S. yields, which were in negative territory from January 2020 through May of 2022, are presently almost 2%, their highest level in fourteen years.

Inflation and monetary policy are important factors in bond market fundamentals. Year-over-year Inflation, which peaked around 9% has fallen to about 3%. All indications are that the Federal Reserve is nearing the end of its tightening cycle.

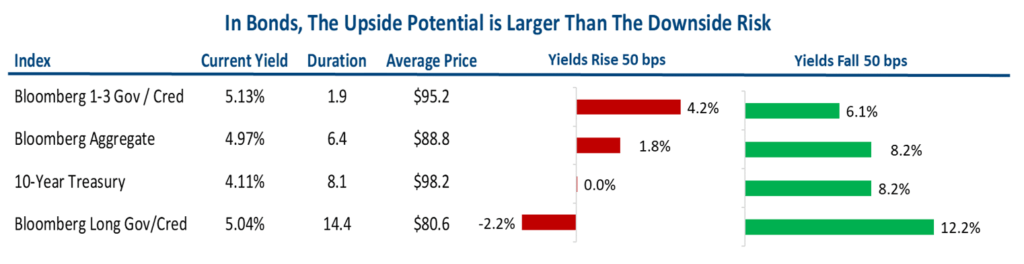

The probability of negative returns for bond investors has been reduced. As the table shows, the average prices of high-quality bonds are below par, which lowers the amount of principal at risk. In addition, higher starting yields provide a cushion against the negative impact on prices if rates were to increase.

Bond bears can point to large, expected Treasury issuance, potential negative credit events, or sticky inflation as risks to the market. Those are valid risks to consider, but the bond market is better positioned to weather those risks and has the potential to produce strong gains if rates have peaked.